BTC Spot ETF Approved, 'Sell on News' Sell-Off Right. "Long-term outlook is positive".

"The U.S. Securities and Exchange Commission's (SEC) approval of spot bitcoin ETF trading last week proved to be a 'sell-the-news' sell-off event," cryptocurrency media outlet CoinDesk reported on Friday, citing analysis from several analysts. Similarly, analysts at Japanese crypto exchange bitBank said, "The ETF approval triggered short-term profit-taking selling pressure. The approval of ETF trading was already a highly anticipated event, and the recovery to $49,000 was a reasonable price point, so it is likely that this price point will become a medium-term high in the future. However, the downside pressure on BTC may be limited given the lower US Treasury yields and the market's optimism for a Fed rate cut. Near-term support is likely at $40,000, which is also a psychological resistance level." 10x Research cited $38,000 as a likely support level. On the other hand, Henry Robinson, founder of Decimal Digital Group, said: "Bitcoin Spot ETFs will change the structure of the industry and allow more traditional asset managers to participate in the market. We expect to see new BTC investments from pension funds, insurance companies, sovereign wealth funds, pension funds and endowments. However, we do not believe that ETFs themselves have an advantage over self-custody due to management fees.

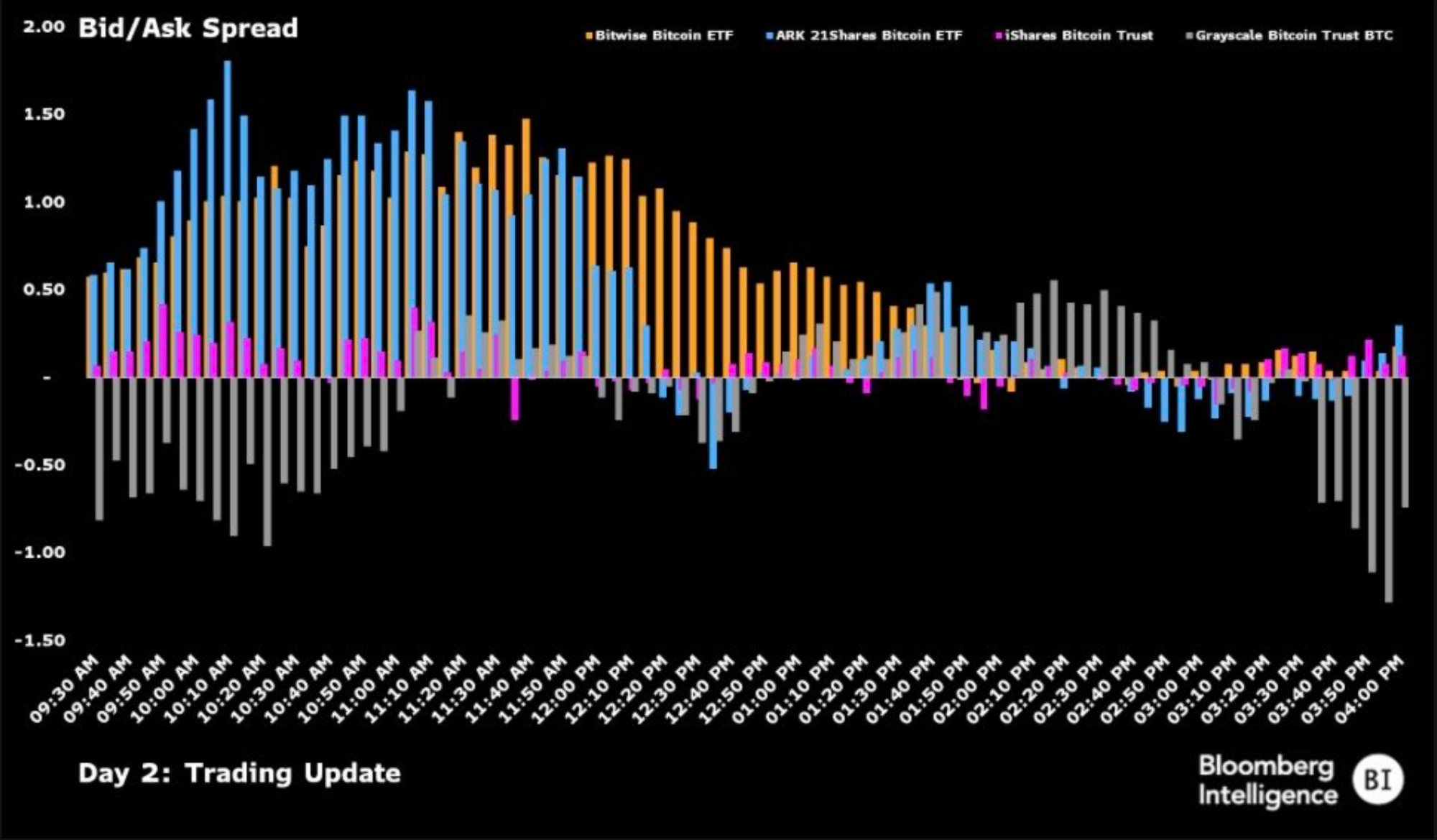

In addition, Eric Balchunas, an analyst specializing in ETFs at Bloomberg, said via X: "It's interesting to look at the bid/ask data the day after the launch of the BTC spot ETF. GBTC had a rare negative spread (bid lower than ask). This shows that there were a lot of investors looking to get out at a lower price. Of course, this is likely to "normalize" again.