In its fourth week of listing, bitcoin spot ETF trading volume tops $1 billion and remains bullish.

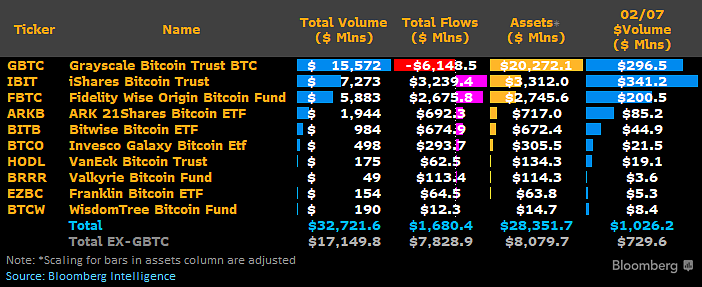

"Trading volume across all bitcoin spot ETFs topped $1 billion on Feb. 7 (local time), with BlackRock's BTC spot ETF, IBIT, topping the list with $3.4 billion," Bloomberg analyst James Seifat reported via X. "The ETFs were followed by Grayscale GBTC ($200 million), Deloitte FBTC ($200 million) and Arc 21 Shares ($200 million). It was followed by Grayscale GBTC ($296 million), Fidelity FBTC ($200 million) and Arc 21 Shares ARKB ($85.2 million).

Meanwhile, bitcoin has reversed its upward trend from the third quarter of last year, with on-chain analytics platform Santiment noting that "bitcoin surpassed $44,500 for the first time since the spot ETF was approved on January 12, likely driven by an increase in the number of addresses holding more than 1,000 BTC. Their total holdings are at a 14-month high." According to the data accompanying the post, addresses holding 1,000 BTC or more have accumulated 1.03% of the total BTC supply over the past four weeks and now hold 40.16% of the total BTC supply.