Now the market's attention is turning to spot Ethereum ETFs. No, it's already here.

Fox Business reporter Eleanor Terrett reports via X that "the chances of the U.S. Securities and Exchange Commission (SEC) approving an ETH spot ETF by May 23 (local time) are diminishing. According to sources, ETH spot ETF applicants and custodians have been trying to reach out to SEC staff in recent weeks to move the approval process forward, but have not received the same meaningful engagement as they have with BTC spot ETF applications.

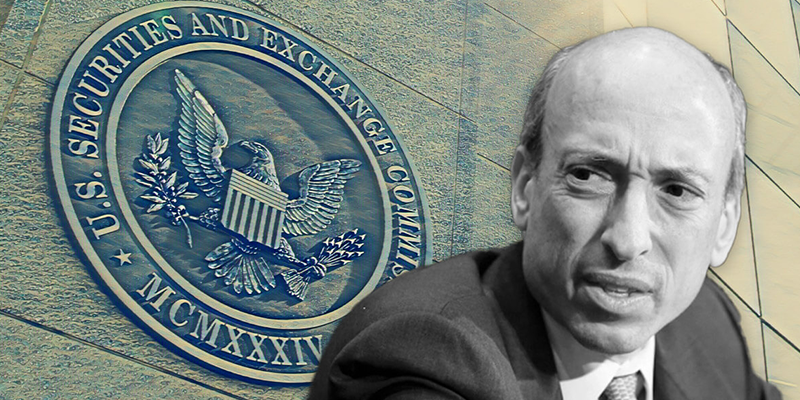

The source explained that "SEC Chairman Gary Gensler is appeasing the industry with BTC spot ETFs that have already been launched. Another obstacle to the approval of an ETH spot ETF is that influential anti-crypto lawmakers like Elizabeth Warren are furious with the SEC for approving the BTC spot ETF and are moving to prevent the same thing from happening to ETH. The SEC staff had a hard time grasping these factors (regarding ETH ETFs)," the source said. If they are serious about the possibility of approval, they need to start working on it sooner rather than later. Previously, Coinness reported that Grayscale lawyers and Coinbase officials had met with SEC staff regarding the ETH spot ETF.

Meanwhile, Nate Geraci, CEO of ETF Store, a US ETF specialist, told X: "If ETH futures and the spot market are not highly correlated, why did the SEC approve the ETH futures ETF? While there is no precedent for forcing the SEC to approve a spot ETF, the Grayscale lawsuit could set a precedent. If the SEC wants to control the crypto market, it would be wise to do so after the approval of the ETH spot ETF.