Analysts "Observe Net BTC Capital Inflows Since May, Expect Bullishness to Continue for at Least 18 Months"

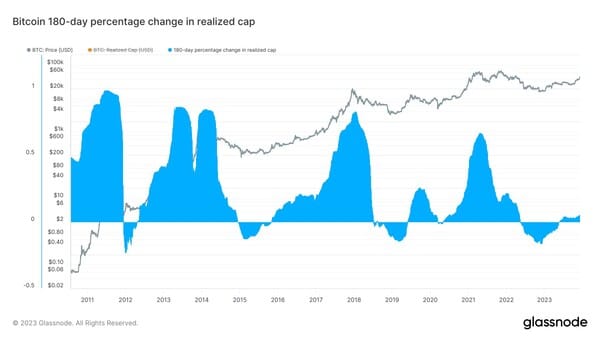

According to CryptoPotato, Will Clemente, an on-chain analyst at crypto research firm Reflexivity Research, reports that "the 180-day 'realized market cap' (the value of the total circulating supply at the most recently traded Bitcoin price) change metric turned positive in May and has continued to do so to date. This suggests that net capital inflows into the Bitcoin market are continuing, and Bitcoin's bull run could continue for the next 18 to 24 months." "This trend is also observed when comparing the on-chain average unit price metric for long-term and short-term holders. Since March, the on-chain bid price of short-term holders has started to exceed the bid price of long-term holders. However, while these metrics indicate a net inflow of capital, they are also accompanied by rising network costs." "While capital inflows are accelerating in anticipation of the U.S. Securities and Exchange Commission's (SEC) approval of a Bitcoin spot ETF next January, a correction is likely to be inevitable due to excessive leverage in the market," he added.