Web3 Infrastructure Revolution: Coinbase's $7B Cross-Chain Bridge, Vitalik's DAO Governance Reform & YouTube's Stablecoin Payments—The 3 Game-Changers Reshaping DeFi in 2026

Coinbase adopts Chainlink CCIP for $7B in wrapped assets, Vitalik Buterin proposes sweeping DAO governance reforms, and YouTube enables PayPal stablecoin payouts. The three innovations redefining Web3 infrastructure in 2026.

Coinbase has selected Chainlink's Cross-Chain Interoperability Protocol (CCIP) as its exclusive bridge for $7 billion in wrapped assets, while Ethereum co-founder Vitalik Buterin calls for a complete redesign of token-based DAO governance, and YouTube introduces PayPal USD (PYUSD) stablecoin payouts for U.S. creators. These aren't isolated headlines—they're three synchronized signals of a structural transformation in DeFi and Web3 infrastructure hitting critical mass in 2026.

Between December 2025 and early February 2026, three core pillars of Web3 infrastructure—cross-chain interoperability, decentralized governance, and stablecoin payments—have experienced simultaneous breakthroughs. According to DefiLlama, total DeFi Total Value Locked (TVL) has recovered to $14 billion in early 2026, while the cross-chain bridge sector alone surged 41.4% in Q2 2025 to reach $4.15 billion. Behind these quantitative gains lies a qualitative leap forward.

Coinbase's adoption of Chainlink CCIP validates that centralized exchanges now trust decentralized oracle networks as mission-critical infrastructure. Vitalik's governance reform proposals confront the accumulated "whale dominance" problem plaguing DAOs since the 2021 boom. YouTube's PYUSD integration marks stablecoins' exit from crypto-native ecosystems into the $10+ billion mainstream creator economy. This article delivers comprehensive analysis of the technical significance, market impact, investment opportunities, and future challenges of these three innovations.

Key Developments Summary

- Coinbase × Chainlink CCIP Exclusive Deal: cbBTC, cbETH, cbXRP and other $7B Coinbase wrapped assets consolidated under single cross-chain bridge. Chainlink's oracle network secures $10B+ DeFi TVL and has processed $2.7 trillion in on-chain transaction value.

- Cross-Chain Bridge TVL Surges 41.4%: Q2 2025 growth from $3.06B to $4.15B. Average transaction size increased 231% ($1,051 → $3,489). Axelar Network recorded 420.2% QoQ growth, signaling explosive cross-chain liquidity expansion.

- Vitalik's DAO Governance Reform: Current state across 200+ DAOs shows top 10% token holders control 76% of voting power (vs. 39% in traditional corporations). Uniswap sees a16z wield unilateral veto power with 15M UNI; Aave's top 3 voters hold 58%. Vitalik proposes AI integration, ZK proof-based privacy voting, Quadratic Voting, and convex/concave problem classification frameworks.

- YouTube PYUSD Stablecoin Payments: U.S. creators can now receive PayPal USD (PYUSD). YouTube sends dollars to PayPal, which handles backend stablecoin conversion. PYUSD market cap grew 680% from $500M (Jan 2025) to $3.9B (Dec 2025). Instant settlement with external wallet transfers enabled.

- Lido Adopts CCIP: Largest liquid staking protocol ($33B TVL) officially adopts CCIP as cross-chain infrastructure for wstETH. CCIP now connects 60+ public and private blockchains.

- DAO Governance Attack Cases: Beanstalk DAO lost $182M when malicious proposer acquired governance tokens via flash loan to pass fund extraction proposal. Jupiter DAO suspended all voting through 2026 for governance reform.

- 2026 DeFi Outlook: Total TVL at $13-14B (still below 2021 peak, recovering from $5B post-FTX). Ethereum maintains 68% dominance. Aave V4 planned with modularity, gas optimization, enhanced cross-chain features.

Why Coinbase Chose Chainlink CCIP: The New Standard for Cross-Chain Security

On December 11, 2025, Coinbase announced it would consolidate all Coinbase Wrapped Assets under Chainlink's Cross-Chain Interoperability Protocol (CCIP). This encompasses $7 billion in assets including cbBTC (Wrapped Bitcoin), cbETH (Wrapped Ethereum), cbXRP, cbDOGE, cbLTC, and cbADA. This marks the first instance of a centralized exchange (CEX) adopting a decentralized oracle network as the sole gateway for cross-chain infrastructure—a landmark demonstrating Web3 infrastructure maturity.

Unlike traditional bridges, Chainlink CCIP employs a dual Decentralized Oracle Network (DON) verification structure. Each cross-chain transaction is validated by two independent oracle networks, meaning even if one network is compromised, the other can reject the transaction. This dramatically reduces operational risk compared to single multisig or custom bridge solutions. Chainlink already secures over $10 billion in DeFi TVL and has processed $2.7 trillion in on-chain transaction value. This establishes CCIP not as experimental technology but as proven infrastructure powering price feeds and data transmission across 70%+ of global DeFi.

Coinbase's decision came shortly after a new bridge between Base network (Ethereum Layer 2) and Solana launched on mainnet. Base, built by Coinbase using the Optimism stack, processed 2 million daily transactions by late 2025 and is experiencing rapid growth. CCIP integration enables Base users to move assets to Solana, Arbitrum, Polygon, and 60+ other chains through a single interface. This represents a breakthrough in user experience (UX). Previously, each chain pair required separate bridges with inconsistent security standards.

Historically, cross-chain bridges have been prime hacker targets. Major 2022 incidents include the Ronin Bridge hack ($625M), Wormhole hack ($320M), and Nomad Bridge hack ($190M). These primarily resulted from attacks on single multisig wallets or smart contract vulnerabilities. Chainlink CCIP's dual DON structure eliminates such single points of failure—if one oracle network is compromised, the other can block validation.

Lido Finance's case is equally noteworthy. With $33 billion TVL as DeFi's largest protocol, Lido officially adopted CCIP as the cross-chain infrastructure for wstETH (wrapped staked ETH) in 2025. wstETH is a liquid staking token that auto-compounds Ethereum staking rewards and is widely used as collateral in multi-chain DeFi. Lido's CCIP adoption symbolizes the convergence of liquid staking and cross-chain interoperability—one of 2026's core DeFi trends.

Cross-chain bridge sector growth is evident in the numbers. According to DefiLlama, cross-chain platform-specific TVL increased 35.5% in Q2 2025 ($3.06B → $4.15B), while the dedicated "bridge" sector grew 41.4%. Average cross-chain transaction size jumped from $1,051 (May 2024) to $3,489 (November 2024), a 231% increase. This suggests that rather than small token movements, institutional investors and high-net-worth individuals are beginning to trust cross-chain infrastructure. Axelar Network recorded 420.2% QoQ growth in Q2 2025, emerging as a breakout cross-chain solution.

Vitalik Buterin's DAO Governance Revolution: Moving Beyond Whale Dominance

In early February 2026, Ethereum co-founder Vitalik Buterin published a series of proposals calling for complete redesign of DAO (Decentralized Autonomous Organization) governance models. He criticized current token-voting systems for failing to achieve genuine decentralization due to whale dominance, decision fatigue, and collusion risks. This represents a frontal assault on structural problems accumulated since the 2021 DAO boom, sending shockwaves through the Web3 community.

Vitalik's core critique centers on voting power concentration. According to 2025 data across 200+ DAOs, the top 10% of token holders control 76% of voting power—double the 39% concentration in traditional publicly-traded corporations. Specific cases illustrate the problem: In Uniswap DAO, where 4% voting participation is required for proposal passage, venture capital firm a16z holds 15 million UNI tokens—granting unilateral veto power. a16z actually used this power to block a Uniswap V3 deployment proposal to BNB Chain. Aave DAO is even more extreme: the top 3 voters control 58% of voting power, with the largest single holder commanding 27.06%. This is effectively oligarchy masquerading as decentralization.

More severe are governance attacks. In 2022, Beanstalk DAO suffered a $182 million theft when a malicious actor acquired massive governance tokens, passed a fund withdrawal proposal, and drained the treasury. The attacker used flash loans to temporarily borrow governance tokens, secure voting power, pass the proposal, and extract funds—all in minutes. This incident exposed fundamental vulnerabilities in token-based voting systems. In January 2026, Jupiter, a major Solana ecosystem DEX, announced it would suspend all voting through end-2026 for governance reform—industry acknowledgment that current DAO models are unsustainable.

Vitalik proposed several innovative frameworks to address these issues. First, combining Quadratic Voting (QV) with Vote Escrow tokens. QV makes voting costs increase quadratically, rendering mass whale voting economically inefficient. For example: 1 vote costs 1 token, 2 votes cost 4 tokens, 10 votes cost 100 tokens. Whales face exponentially higher costs to dominate voting, while multiple small holders voting 1-5 times each can collectively outweigh a single whale. Vote Escrow grants voting power through long-term token lockups, favoring long-term community members over short-term speculators. Curve Finance already successfully operates this model with veCRV (Vote Escrowed CRV).

Second, ZK Proof-based privacy voting. Vitalik noted that current DAO votes are fully public, turning voting into a "social game" and political theater rather than genuine decision-making. ZK Proofs enable hiding voter identity and vote amounts while verifying result validity. This blocks external pressure and bribery. As of early 2026, ZK-based privacy protocols like Aztec Network and zkSync are developing DAO governance toolkits.

Third, convex/concave problem classification. Vitalik divided DAO issues into two categories. Convex problems are where the average of multiple inputs yields optimal solutions (e.g., determining protocol fee rates)—token-weighted voting is rational here. Concave problems have clear right/wrong answers (e.g., smart contract bug fixes)—expert committees or dispute resolution mechanisms are more appropriate. Vitalik emphasized that attempting to solve all problems via token voting creates "one-size-fits-all" inefficiency in DAOs.

Fourth, AI integration. Vitalik proposed using AI to reduce decision fatigue while maintaining human final approval. For example, AI could pre-filter and summarize hundreds of proposals, allowing DAO members to focus on core issues. This addresses the current problem where most DAO members vote without properly reading complex proposals. By late 2025, Compound DAO began piloting an AI-based proposal summarization system.

Vitalik's proposals aren't merely theoretical—they're being tested in the Ethereum ecosystem. Optimism's Citizen House introduced citizenship-based voting rather than token-based. Gitcoin uses Quadratic Funding to democratically allocate funding to public goods projects. MakerDAO recently announced its Endgame Plan, transitioning complex governance to multiple SubDAOs, each with expert committees. These experiments mark the starting point of DAO Governance 2.0 in 2026.

YouTube × PayPal Stablecoin Payments: Web3 Meets Mainstream Creator Economy

On December 11, 2025, YouTube officially launched PayPal USD (PYUSD) stablecoin payment options for U.S. creators. This marks the first time the world's largest video platform—distributing $10+ billion annually to creators—has adopted cryptocurrency payments, symbolizing stablecoins' transition from crypto-native ecosystems into the mainstream economy.

PYUSD is a dollar-pegged stablecoin launched by PayPal in August 2023, issued by Paxos under U.S. regulatory compliance. 1 PYUSD always equals 1 USD, 100% backed by dollar deposits and U.S. Treasury securities held by PayPal. YouTube's integration works as follows: YouTube sends creator earnings to PayPal in dollars as usual, and PayPal handles backend conversion to PYUSD. Creators simply select "Receive PYUSD" in YouTube account settings without managing crypto wallets directly. This design minimizes Web3 onboarding friction.

PYUSD payment advantages are clear. First, instant settlement. Traditional bank transfers take 3-5 business days; PYUSD settles in seconds. Second, borderless mobility. Creators can move PYUSD to external crypto wallets (MetaMask, Coinbase Wallet), use it at PYUSD-accepting merchants, or convert back to dollars. Third, fee reduction. International wire transfers charge 3-7% fees; PYUSD only incurs blockchain gas fees (a few dollars or less on Ethereum).

PYUSD growth has been steep. Market cap surged from $500 million (January 2025) to $3.9 billion (December 2025)—a 680% increase. PayPal CEO Alex Chriss announced PYUSD expansion as a core 2026 strategy. Beyond YouTube integration, PayPal enables PYUSD transfers on Venmo (PayPal's P2P payment app) and is expanding infrastructure so millions of U.S. merchants can accept PYUSD payments. This builds a closed-loop stablecoin economy—leveraging PayPal's vast merchant network (300+ million accounts) to make PYUSD usable beyond crypto exchanges.

Stablecoin mainstream adoption is one of 2026's clearest trends. Venture capital firm a16z's 2026 crypto outlook report emphasizes stablecoins transitioning from crypto pipelines to payment infrastructure. Currently, stablecoins primarily facilitate exchange-to-exchange transfers and DeFi collateral, but from 2026 forward they're being rapidly adopted for cross-border B2B payments, contractor payroll, and supply chain settlements in the real economy. Stablecoin demand is exploding especially in regions where traditional financial friction is high (Latin America, Southeast Asia, Africa).

However, regulatory uncertainty persists. In the U.S., stablecoin regulatory legislation is under congressional discussion in early 2026. The European Union's MiCA (Markets in Crypto-Assets) regulation, enforced since 2024, imposes strict capital requirements and transparency on EU stablecoin issuers. PYUSD currently operates only in the U.S.; global expansion requires compliance with each jurisdiction's regulations. Additionally, Circle's USDC ($50B market cap) and Tether's USDT ($140B market cap) already dominate the stablecoin market. For PYUSD to secure competitive advantage, it must maximize PayPal's merchant network and user convenience.

Where Three Innovations Intersect: Web3 Infrastructure Convergence

Coinbase's cross-chain bridge, Vitalik's DAO governance reform, and YouTube's stablecoin payments may appear independent, but they actually paint one unified picture: Web3 infrastructure convergence. Cross-chain interoperability connects disparate blockchains, DAO governance enables decentralized organizations to function effectively, and stablecoins bridge Web3 with the real economy. Only when all three mature can Web3 truly become "the next stage of the internet."

Specifically, Coinbase's CCIP integration solves liquidity fragmentation. Current DeFi liquidity is scattered across dozens of chains—Ethereum, BSC, Arbitrum, Polygon, Solana, etc. Moving assets from Ethereum to Solana previously required going through centralized exchanges or using low-trust bridges. Unified bridges like CCIP make this a one-click operation. Once Lido's wstETH becomes available across all chains via CCIP, users can earn Ethereum staking rewards while simultaneously borrowing on Arbitrum DeFi protocols or using assets in Polygon games. This maximizes capital efficiency.

Vitalik's DAO governance reform is an essential condition for sustainable decentralization. Currently, most DAOs are decentralized in name only—in practice, a few whales or VCs dominate. This undermines Web3's core value: decentralization. If mechanisms like Quadratic Voting, ZK privacy voting, and expert committees take hold, DAOs can evolve from mere "token voting clubs" into genuine decision-making organizations. For example, when Aave DAO adds new collateral assets or Uniswap DAO changes fee structures, if these truly reflect the entire community's will, protocol legitimacy and sustainability dramatically increase.

YouTube's PYUSD payments symbolize Web3 popularization. Crypto has long been perceived as the domain of early adopters and speculators. But if YouTube creators receive stablecoin earnings and use them for daily payments, cryptocurrency transitions from "speculative asset" to "practical tool." PayPal's 300-million-user network is critical infrastructure for this transition. PYUSD is also powerful for cross-border remittances. For example, a Filipino YouTube creator receiving PYUSD earnings can convert to pesos at a local crypto exchange, saving 70%+ on fees versus traditional bank wire transfers.

Synthesizing the three innovations, 2026 Web3 is shifting from "technology experiment" to "infrastructure transition." Chainlink CCIP handles blockchain interoperability, Vitalik's proposals operationalize decentralized governance, and PYUSD connects to the real economy. When all three axes strengthen, Web3 will no longer be a "parallel universe" but rather next-generation financial and organizational infrastructure integrated with the existing internet economy.

Historical Context: 2021 DeFi Summer vs. 2026

Understanding 2026's Web3 infrastructure innovations requires comparison with 2021's "DeFi Summer." In summer 2021, DeFi TVL exceeded an all-time high of $250 billion, with protocols like Uniswap, Aave, and Compound recording tens of billions in daily volume. DAOs proliferated; ConstitutionDAO raised $47 million to attempt purchasing an original U.S. Constitution copy (failed, but demonstrated DAO potential). However, the 2022 Terra-Luna collapse, Three Arrows Capital bankruptcy, and FTX implosion rapidly cooled the market, with DeFi TVL plummeting to $5 billion.

The biggest difference between 2021 and 2026 is maturity. 2021 was the era of "experimentation and speculation." New protocols launched weekly, most focused solely on token price appreciation. Governance was perfunctory; security was often overlooked. By contrast, 2026 is the era of "infrastructure and utility." Coinbase chose Chainlink CCIP because it prioritized proven security. Vitalik's DAO reform proposals resulted from analyzing five years of governance failures. YouTube's PYUSD integration proves stablecoins function as payment instruments, not speculation vehicles.

Another difference is regulatory clarity. In 2021, it was unclear how the U.S. SEC would regulate DeFi. Between 2024-2026, major jurisdictions including the U.S., Europe, Singapore, and Japan built cryptocurrency regulatory frameworks. This provides institutional investors with legal certainty and facilitates long-term capital inflows. Indeed, traditional finance giants like BlackRock and Fidelity launched Bitcoin and Ethereum ETFs, channeling tens of billions in institutional funds into crypto markets.

2021 DAOs were mostly "memes." Launching a token, creating a Discord channel, and voting was the extent of activity. Actual decisions were made by a few founders. 2026 DAOs are evolving. MakerDAO manages $8+ billion in assets and has introduced Real-World Asset (RWA) collateral. Optimism allocated 100 million OP tokens for public goods funding. Gitcoin has supported thousands of open-source projects. These aren't mere "token clubs" but decentralized organizations with real impact.

Key Metrics for Investors and DeFi Participants

- CCIP Integration Protocol Growth: Beyond Coinbase and Lido, Aave V4 and Synthetix V3 are enhancing cross-chain capabilities. Combined TVL of CCIP-integrated protocols projected to exceed $20B. Chainlink (LINK) tokens are used to pay CCIP fees, so integration growth may drive LINK demand.

- Cross-Chain Bridge TVL $5B Breakthrough Potential: Expected to surpass $5B by end-2026 from $4.15B in Q2 2025. Watch emerging bridge protocols Axelar and LayerZero. Holding their governance tokens (AXL, ZRO, etc.) may yield airdrops and staking rewards.

- DAO Governance Reform Protocols: Snapshot X (ZK-based voting), Tally (DAO governance analytics), Aragon (DAO infrastructure) are implementing Vitalik's proposals. Increased adoption may boost related tokens (e.g., ANT).

- PYUSD vs. USDC/USDT Competition: PYUSD's $3.9B market cap remains small versus USDC ($50B) and USDT ($140B). However, considering PayPal's 300M+ user base, growth potential is significant. Watch for additional mainstream platform integrations beyond YouTube.

- DeFi TVL $20B Recovery: Breaking $20B by end-2026 from current $13-14B signals bull market. Ethereum gas fee reduction (Dencun upgrade) and L2 growth are catalysts. Potential "flippening" where combined Arbitrum, Optimism, Base TVL exceeds Ethereum mainnet.

- Risk: Regulatory Volatility: U.S. SEC enforcement against DeFi protocols remains possible. Crypto policy may shift based on 2026 midterm election results. EU MiCA enforcement may restrict some protocol access in Europe.

- Risk: Smart Contract Vulnerabilities: New infrastructure like CCIP and DAO governance contracts are hacking targets. Despite Chainlink's CertiK and Trail of Bits audits, complex cross-chain logic may harbor unexpected bugs. Diversification essential.

2026 H2 Scenario Analysis: Bull and Bear Cases

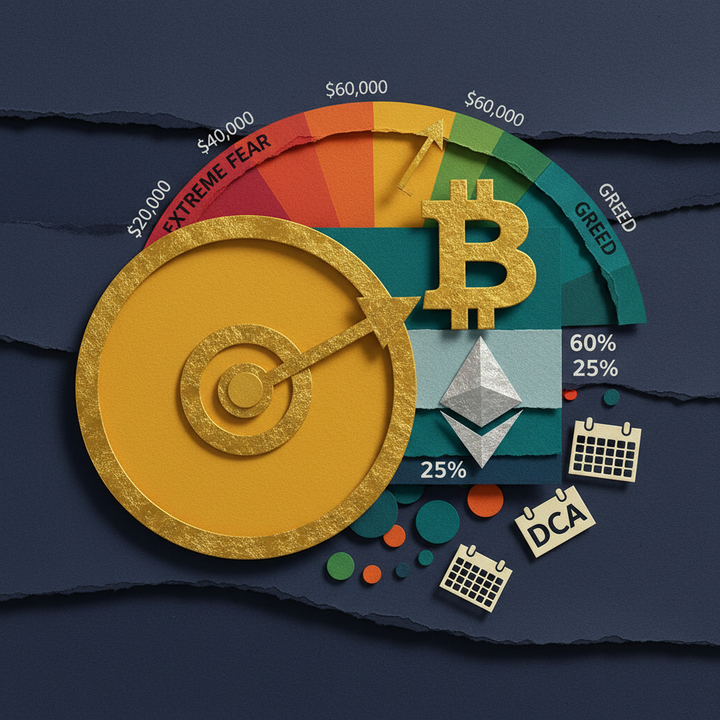

Bull Scenario (60% probability): Ethereum's Pectra upgrade (scheduled Q3 2026) completes successfully, reducing gas fees 70%. CCIP-integrated protocol TVL breaks $30B; cross-chain liquidity integration drives total DeFi TVL recovery to $25B. Vitalik's reforms—Quadratic Voting + ZK privacy voting—pilot in Uniswap and Aave, reducing whale dominance from 76% to 60%. PYUSD market cap surpasses $10B with Stripe and Shopify integrations. Bitcoin ETF inflows push BTC past $100K, lifting altcoins and DeFi tokens. Targets: LINK $50, AAVE $300, UNI $20.

Bear Scenario (40% probability): U.S. SEC sanctions select DeFi protocols as "unregistered securities," chilling markets. Unexpected smart contract bug in Chainlink CCIP causes temporary service disruption, damaging trust. DAO governance reform fails due to community resistance (whale pushback). PYUSD growth stalls against USDC/USDT. Macro deterioration (U.S. recession, rate hikes) drags down risk assets broadly. DeFi TVL falls below $10B. Supports: LINK $12, AAVE $100, UNI $5.

Neutral Scenario (baseline): Cross-chain, DAO, stablecoin innovations progress gradually without explosive growth. DeFi TVL ranges $15-18B. PYUSD reaches $5B market cap. Regulation holds at current levels. Ranges: LINK $25, AAVE $180, UNI $12.

Practical Investment Strategies: Capitalizing on Web3 Infrastructure Innovation

Long-Term Hold (HODL) Strategy: Diversify into protocol tokens with real utility and TVL like Chainlink (LINK), Aave (AAVE), Uniswap (UNI). Unlike 2021 short-term speculation, these have sustainable business models (fee revenue, staking rewards). LINK is used for CCIP fee payments; increased integration drives demand. AAVE leads DeFi lending with $12B TVL. UNI dominates DEX volume. 3-5 year hold may yield 5-10x returns from current levels.

Liquidity Provider (LP) Strategy: Supply liquidity on Uniswap V4, Curve for pairs like PYUSD/USDC, wstETH/ETH. PYUSD growth drives pair trading volume, increasing fee revenue. wstETH multi-chain demand expected to rise via CCIP integration. Manage impermanent loss risk; stablecoin pairs minimize IL.

DAO Governance Participation: L2 protocols like Optimism, Arbitrum, Polygon offer airdrops and governance incentives. Using DeFi protocols on these networks may qualify for future airdrops. Some protocols reward voters via Snapshot and Tally. Consistent small participation yields long-term benefits.

Risk Hedging: Keep 30-50% of DeFi portfolio in major assets like BTC and ETH. Hold 20% in stablecoins (USDC, DAI) to maintain buying power during dips. Use on-chain insurance protocols like Nexus Mutual and InsurAce to hedge smart contract risk (annual premium 2-5%).

For deeper DeFi protocol comparisons, airdrop strategies, and cross-chain LP yield simulations, explore real-time market insights at Spoted Crypto Premium Analysis. Stay ahead of the Web3 infrastructure revolution with expert-curated research and actionable intelligence.

Frequently Asked Questions

Why is Chainlink CCIP more secure than traditional cross-chain bridges?

CCIP uses a dual Decentralized Oracle Network (DON) verification structure. Each cross-chain transaction is validated by two independent oracle networks, so even if one network is compromised, the other can reject the transaction. Chainlink already secures over $10 billion in DeFi TVL and has processed $2.7 trillion in on-chain transaction value—proven infrastructure. Traditional bridges mostly relied on single multisig wallets or custom smart contracts with single points of failure, leading to 2022's major hacks like Ronin ($625M) and Wormhole ($320M).

How does Vitalik's Quadratic Voting prevent whale dominance?

Quadratic Voting (QV) makes voting costs increase quadratically. For example: 1 vote costs 1 token, 2 votes cost 4 tokens, 10 votes cost 100 tokens, 100 votes cost 10,000 tokens. Whales face exponentially higher costs to dominate voting, making it economically inefficient. Meanwhile, multiple small holders voting 1-5 times each can collectively outweigh a single whale. Combined with Vote Escrow (long-term lockup), this favors long-term community members over short-term speculators. Curve Finance's veCRV model already demonstrates successful implementation.

How are taxes handled when YouTube creators receive PYUSD?

Under U.S. tax law, receiving PYUSD is treated identically to receiving dollars. YouTube issues 1099 tax forms to creators, and PYUSD earnings must be reported as taxable income regardless of currency. Since PYUSD maintains a fixed 1:1 peg to USD, no additional capital gains tax applies upon receipt. However, if PYUSD is later exchanged for other cryptocurrencies, capital gains tax may apply on price differences at that time. Creators in other countries must comply with local tax regulations; international remittance tax treatment can be complex, so consulting tax professionals is recommended.

Is DeFi TVL breaking $20B a bull market signal?

Historically, DeFi TVL reflects overall crypto market health. During 2021 DeFi Summer, TVL exceeded $250B with BTC hitting $69K. Post-FTX 2022, TVL crashed to $5B as BTC fell to $15K. Early 2026 TVL of $13-14B shows recovery but remains far below 2021 peaks. Breaking $20B signals institutional capital and user confidence returning, interpreted as bullish. However, TVL alone is insufficient—consider BTC/ETH prices, trading volume, on-chain activity (active addresses), and macro indicators (interest rates, dollar index) holistically. Also distinguish whether TVL growth reflects genuine user increase or merely nominal gains from token price appreciation.

What's the biggest risk when using cross-chain bridges?

The primary risk is smart contract vulnerabilities. Bridges handle complex logic (locking assets on source chain → minting on target chain), increasing bug probability. Nomad Bridge lost $190M in 2022 from a single-line code error. Second risk: centralized validators. Some bridges rely on few multisig signers to approve transactions; if signers are hacked or collude, funds can be stolen. Decentralized oracle-based bridges like CCIP mitigate this. Third risk: insufficient liquidity. Some bridges lack target chain liquidity, causing slippage on large transfers. Before using bridges, verify security audit history, TVL, and operational track record; split large transfers into multiple transactions for safety.

What benefits come from participating in DAO voting?

Direct benefits include governance rewards. Protocols like Optimism and Arbitrum airdrop additional tokens or provide staking rewards to voters. Indirect benefits involve influencing protocol direction. For example, voting on Uniswap DAO fee structure changes directly impacts your LP earnings. DAO participation also offers community networking opportunities—engaging with core developers and investors on Discord and forums provides valuable information. Long-term active members may be elected to protocol committees, gaining greater influence. However, voting incurs gas fees (Ethereum: $5-20) and requires time investment to properly understand proposals.

What's the most promising DeFi sector in 2026?

2026's most promising DeFi sectors are cross-chain liquidity aggregation, Real-World Asset (RWA) tokenization, and liquid staking derivatives. First, as cross-chain infrastructure like CCIP matures, multi-chain DEXs and cross-chain lending protocols will surge. Second, protocols like MakerDAO and Centrifuge are bringing real-world assets—real estate mortgages, corporate bonds—on-chain as DeFi collateral, potentially expanding DeFi TVL to trillions. Third, liquid staking tokens like Lido's wstETH and Rocket Pool's rETH enable earning Ethereum staking rewards (3-5% APY) while simultaneously generating additional DeFi yields. As Ethereum's Pectra upgrade makes staking more flexible, liquid staking TVL is projected to exceed $100B. Additionally, AI-DeFi convergence (AI-powered automated trading, risk management) warrants attention.

Sources

- Coinbase Taps Chainlink CCIP as Sole Bridge for $7B in Wrapped Tokens Across Chains, CoinDesk

- Coinbase taps Chainlink CCIP to expand wrapped assets like cbBTC and cbXRP to new chains, The Block

- Vitalik Buterin Criticizes Current DAOs, Calls for Reform, ForkLog

- Vitalik Buterin Calls for a Rethink of DAOs Beyond Token-Holder Voting, AIinvest

- YouTube launches option for U.S. creators to receive stablecoin payouts through PayPal, Fortune

- YouTube Now Allows U.S. Content Creators to Get Paid in PayPal's Stablecoin, CoinDesk

- Cross-Chain Interoperability Protocol (CCIP), Chainlink

- Partnership With Chainlink on Adopting CCIP as Official Cross-Chain Infrastructure For wstETH, Lido

- DAO voting mechanism resistant to whale and collusion problems, Frontiers in Blockchain

- Paradox of Power: How DAOs Struggle with Centralization and Ineffective Leadership, BeInCrypto

- Stablecoins Became Useful in 2025, Can They Become Ubiquitous in 2026?, PYMNTS

- 5 Stablecoin Trends Shaping Global Payments in 2026, Thunes

- DefiLlama - DeFi Dashboard, DefiLlama

- 6 trends for 2026: Stablecoins, payments, and real-world assets, a16z crypto