Bloomberg Analyst: "SEC to Ignore ETH=Commodity...Spot ETF Approval Likely Within Year"

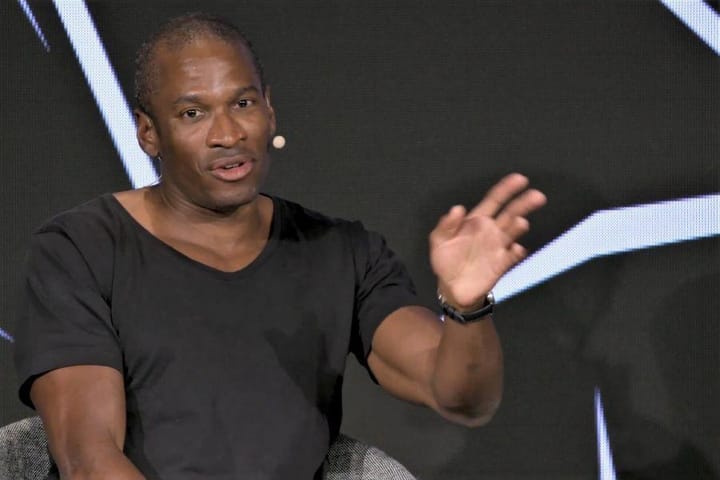

According to Cointelegraph, Bloomberg analyst James Seyffart participated in a CryptoQuant webinar on Thursday and said, "The U.S. Securities and Exchange Commission (SEC) has tacitly accepted that Ethereum (ETH) is a commodity. As such, we believe it is highly likely that an ETH spot ETF will be approved this year." "The U.S. Commodity Futures Trading Commission (CFTC) explicitly refers to ETH as a commodity. The SEC has also approved an Ethereum futures ETF. SEC Chairman Gary Gensler has not taken a clear position on whether ETH should be classified as a security or a commodity. However, it is unlikely that the SEC will challenge ETH's classification as a commodity." "Even if an Ethereum spot ETF is approved later this year, it is doubtful that staking will be allowed," Seifat added in response to the report.

In another comment, he said, "I personally do not expect the SEC to approve the launch of a Bitcoin spot ETF on the 5th (local time)." "I still expect a decision to be made between January 8 and January 10," he added. Earlier, Jacquelyn Melinek, a reporter for TechCrunch, a leading U.S. tech publication, told X that she had "heard from multiple sources familiar with the matter that the SEC will approve a number of BTC spot ETFs."