'Less than two years away'...expectations of a US rate cut drastically reduced amid high inflation

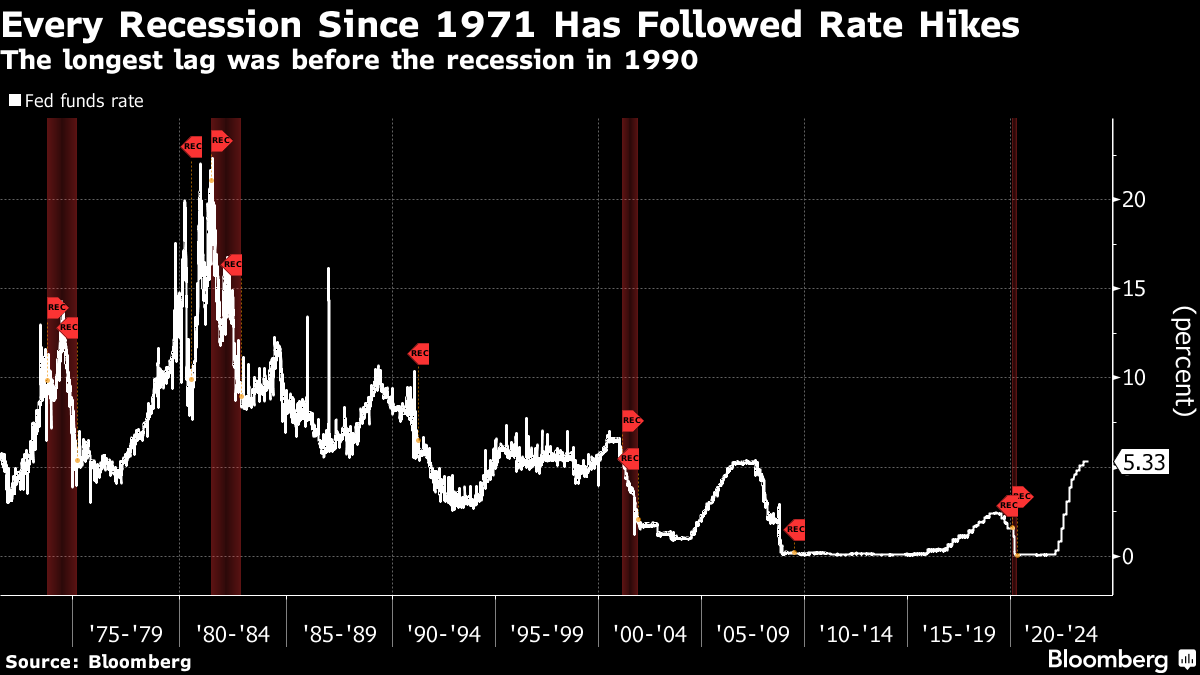

Expectations for the Federal Reserve (Fed) to cut its benchmark interest rate further diminished as U.S. underlying inflation beat market expectations for a third straight month. Market participants now see two rate cuts this year, with a growing number expecting just one. The likelihood of the first rate cut in July has dropped significantly, from 98% to 50%.

Former U.S. Treasury Secretary Larry Summers, who has consistently criticized the Fed's rate cuts as inadequate, pointed out that the Fed may "raise" rates next time, rather than "lower" them. According to Bloomberg and Reuters on Tuesday (local time), market participants' interest rate swaps are weighing in on the idea that the benchmark rate will be 40 basis points (1 basis point = 0.01 percentage point) lower than it is now later this year. The Fed typically adjusts the benchmark rate 25 basis points (bp) at a time, so two rate cuts would result in a 50-bp reduction. Therefore, expecting only a 40-bp reduction means that the Fed is expected to cut rates less than twice.

This is a significant change from earlier this year, when the prevailing view was that the Fed would cut rates six times, totaling 1.5 percentage points, starting in March. Bond rates jumped across the board on news that the U.S. Consumer Price Index (CPI) rose 3.5% year-over-year in March. Most Treasury rates rose about 20 basis points, the biggest jump in months. The policy-sensitive two-year Treasury note rose nearly 23 basis points to 4.97%, while the benchmark 10-year Treasury note rose above 4.5% for the first time since November last year.

"While inflation is down more than 60% from its peak, we still have a lot of work to do to lower the cost of living for hardworking families," U.S. President Joe Biden said after the inflation data was released. "Inflation is leveling off around 3%, which will force the Fed to keep rates on hold," said Camp Goodman, fixed-income portfolio manager at The Hartford Funds.

Wall Street lenders also dimmed their outlook. Goldman Sachs pushed back its forecast for the timing of a rate cut from June to July, while Barkley Group said it expects only one rate cut this year. Former Secretary Larry Summers told Bloomberg TV: "You have to take seriously the possibility that the next Fed action is not a 'rate cut' but a 'rate hike'. The probability of a hike is 15% to 25%," he said. "Based on the current data, cutting rates in June would be a dangerous and serious mistake, comparable to the mistake the Fed made in the summer of 2021," he said, emphasizing that "a rate cut is not needed right now."

Meanwhile, the European Central Bank (ECB) is almost certain to keep its benchmark interest rate unchanged this week, but is likely to hint at a June rate cut given the sharp slowdown in euro area inflation and weakening economic conditions, Reuters reported. The U.S. Federal Reserve's slow pace of rate cuts is a stumbling block, but the economic situation between the U.S. and the eurozone is unlikely to prevent the ECB from cutting rates.