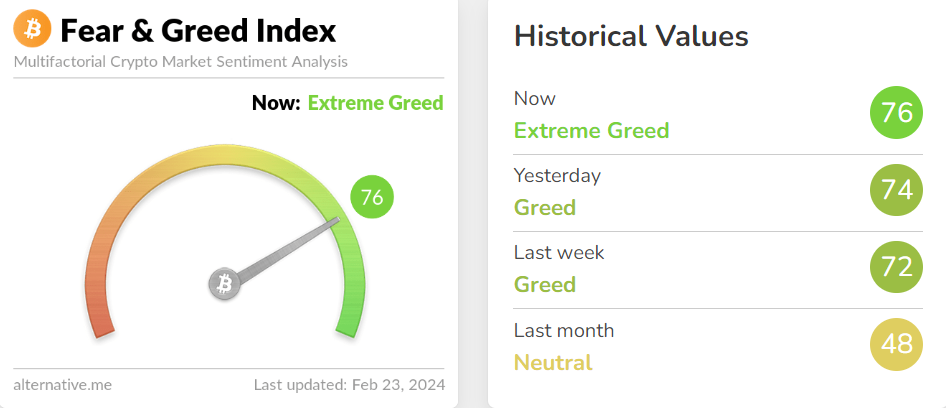

Crypto 'Fear-Greed Index' at 76, indicating extreme greed, warns crypto analysts to watch for correction

Crypto data provider Alternative's self-assessed "Fear-Greed Index" rose two points from the previous day to 76. The improved sentiment moved the index from the greedy stage to the extreme greed stage. The index is a measure of extreme fear in the market, with a reading closer to zero indicating extreme fear and a reading closer to 100 indicating extreme optimism. The Fear Greed Index is calculated based on volatility (25%), trading volume (25%), social media mentions (15%), surveys (15%), bitcoin market capitalization (10%), and Google searches (10%).

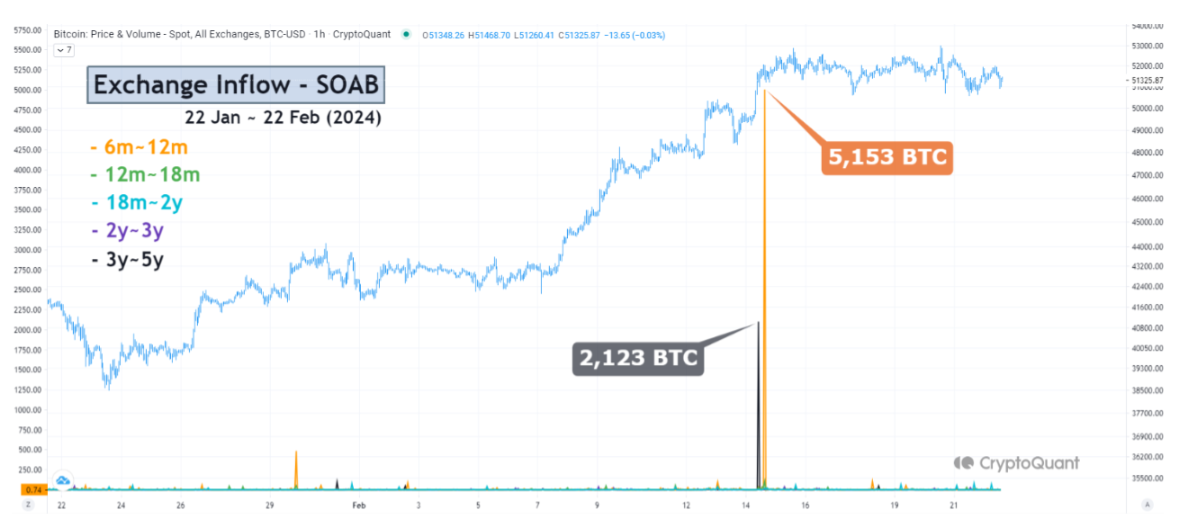

"The recent exchange inflow Spent Output Age Bands (SOAB) indicator suggests that bitcoin volume is shifting from long-term investors (LTH) to short-term holders (STH)," said another crypto analyst contributor. "When the BTC price broke through $51,000 on the 14th, 5,153 BTC of the 6-12 month holders flowed into exchanges. This cohort are the holders who bought BTC in 2023 in the $20,000 to $32,000 price range. This suggests that they are taking profits.

There was also a temporary spike in the inflow of 3-5 year holders to exchanges, who bought BTC during the 2019-2021 bull run, to 2,123 BTC. The influx of long-term holders into the exchange can be interpreted as a price signal that accompanies a short-term correction. However, compared to previous cycles, the inflow of long-term holders to exchanges is relatively small." SOAB is an on-chain metric that shows the percentage of old funds moving on the network according to their age band.