Open Season? What is the bitcoin halving?

The halving of the world's leading cryptocurrency, bitcoin, is just around the corner. In April of this year, bitcoin will enter a so-called "halving" period, when the amount of bitcoin mined will be halved. Today, we're going to break down the information about the bitcoin halving.

Wait, what is halving?

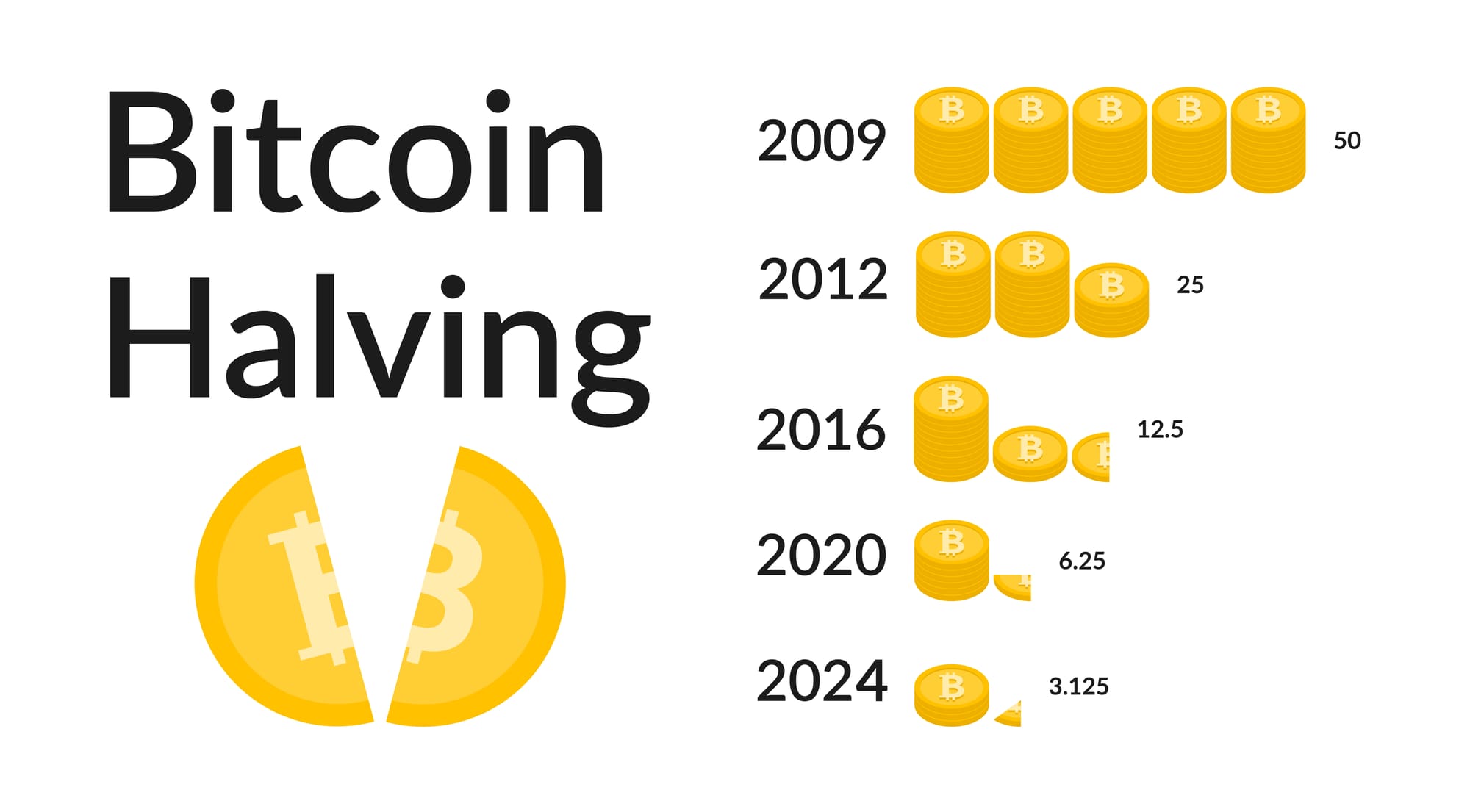

Bitcoin halving is the halving of the number of Bitcoins paid out as a reward for mining. It happens every four years, and there have been three halving periods since bitcoin was created in 2009. The reason for the halving is that Satoshi Nakamoto, the creator of Bitcoin and the man who is considered the god of the cryptocurrency market, introduced halving when he first created Bitcoin, limiting the supply to 21 million until 2140 and reducing the mining reward at a certain point in time.

Bitcoin's first halving was in November 2012, when the mining reward was reduced from 50 to 25 per block. The second halving was in 2016, when the mining reward was reduced from 25 to 12.5. The third halving was on May 20, when the mining reward was reduced to 6.25.

So what's different about the halving?

First of all, the less there is on the market, the more valuable it becomes. The more expensive something is, the less of it there is. Before and after each of the previous three halving events, the price of bitcoin was strong: the first halving saw it jump from $12 to $1100, and the second halving saw it jump from $650 to $19,000.

After the third halving, the price went from $8800 to $69,000 in 18 months, so there is a general expectation that the halving of bitcoin will increase the price. Given the current rate of block creation, a fourth halving is expected around May next year. On the other hand, some argue that changes in mining output do not have a significant impact on the price of bitcoin.

On the other hand, there are analysts who believe that the price of bitcoin is more affected by macroeconomics and liquidity than by halving, as investors in bitcoin already know and prepare for the decrease in block reward. We hope you enjoyed this article and stay tuned for the next one!