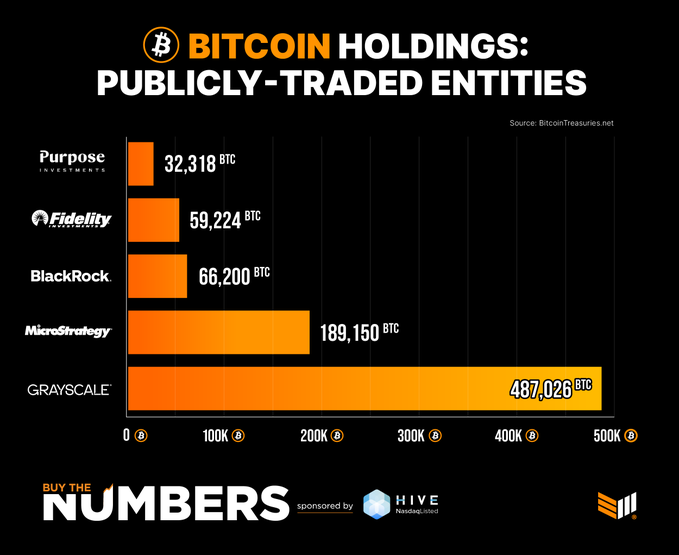

Grayscale, MicroStrategy and BlackRock top three firms by BTC holdings

The top five companies (institutions) that disclose their bitcoin holdings have been ranked, with Grayscale taking the top spot with 487,026 BTC, MicroStrategy (MSTR) in second place with 189,150 BTC, and BlackRock in third place with 66,200 BTC. Fidelity (59,224 BTC) and Canadian BTC ETF manager Posse Investments (32,318 BTC) rounded out the top four.

"GBTC, the Grayscale Bitcoin Spot ETF, experienced net outflows of 140,195 BTC ($5.83 billion) after 15 trading days," BitMEX Research said in a statement. On February 1 (local time), the 15th trading day of the BTC Spot ETF, GBTC saw net outflows of $182 million in assets. Meanwhile, according to Grayscale's official website, GBTC held approximately 482,592.1829 bitcoins as of February 1, a decrease of approximately 4,433 BTC from the previous day. GBTC currently has approximately $207.41 billion in assets under management, with 540,120,100 shares outstanding. "The Bitcoin Spot ETF has seen cumulative net inflows of approximately $1.7 billion through 14 trading days, surpassing the net inflows of the Gold ETF ($1.3 billion) over the same period," said Matt Hogan, Chief Investment Officer at Bitwise, via X. "The ETF has seen net inflows of approximately $1.7 billion.