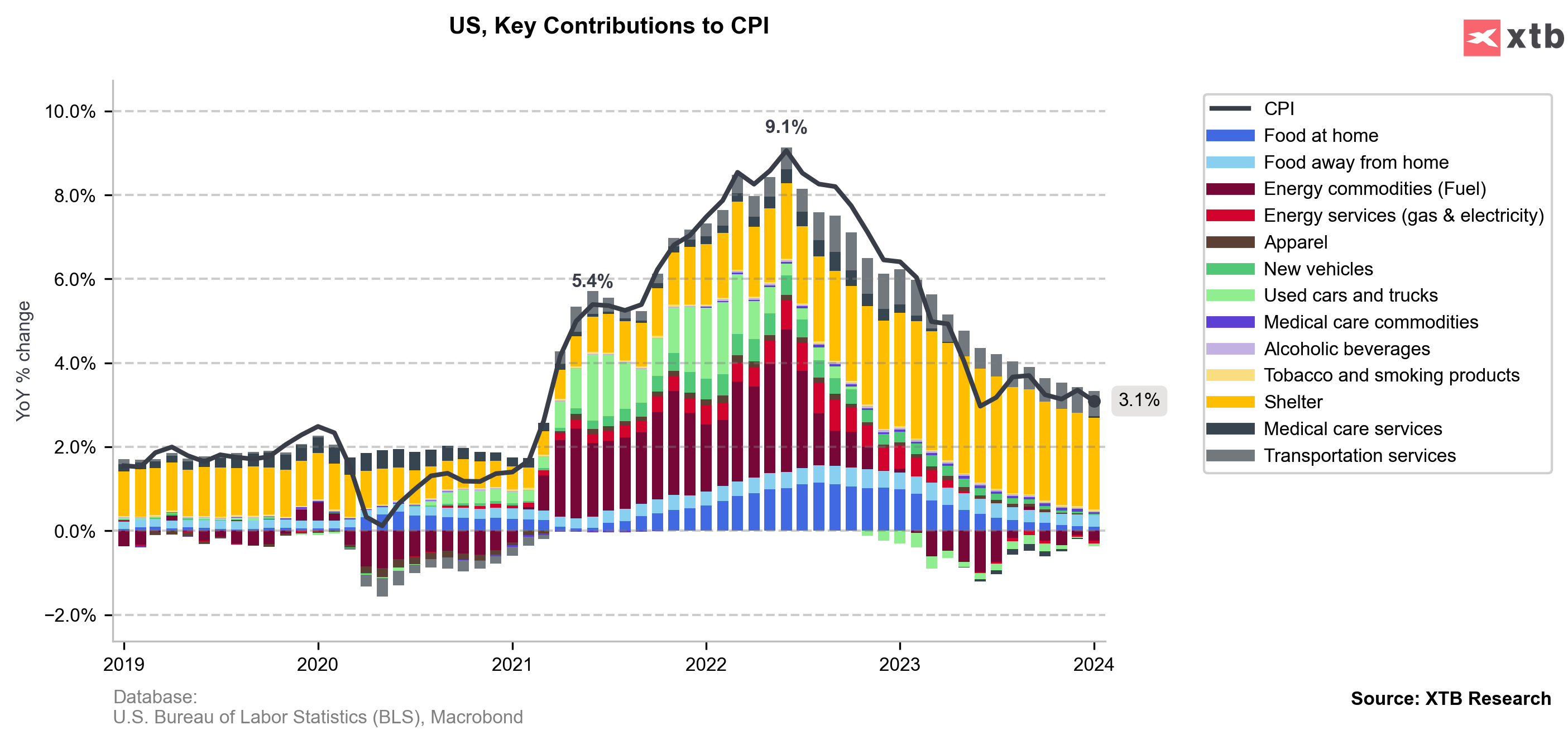

The release of the US CPI data triggers volatility in investments and US equities close lower, including the relentless S&P500

After the release of the US CPI data, there was a reversal in investment assets. Major investment assets such as bitcoin, crypto, stocks and gold fell, while Treasury yields and dollar index oil prices rose.

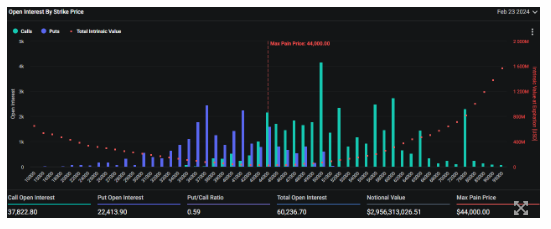

Meanwhile, The Block, citing Derrybit data, reported that a significant amount of open interest is concentrated in bitcoin call options with strike prices of $60,000, $65,000 and $75,000 expiring on February 23. The media outlet explained that the concentration of calls above the $60,000 strike suggests that many investors expect bitcoin to rise above that price by the end of the month. In response, Jag Kooner, head of derivatives at Bitfinex, said: "$50,000 is a psychologically important price level for bitcoin. As attempts to break above this level continue, traders are writing call options with strikes well above the current price. These strike prices are higher than in previous cycles," he explained. BTC is currently trading down 1.51% at $49,419.35 on CoinMarketCap.