Bitcoin hits $64K, is the trend a roller coaster?

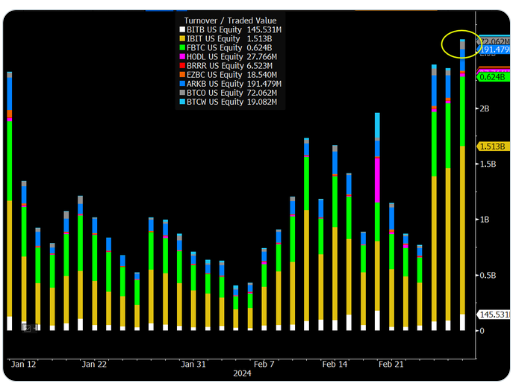

First, trading volume in the spot Bitcoin ETFs that are driving this bull run more than doubled the previous record to more than $7.5 billion, with BlackRock leading the way with $3,291,107,443, Grayscale with $1,836,035,297, and Ark Investments with $425,812,381. Commenting on IBIT's volume via his X, Bloomberg analyst Eric Balchunas called it "absolutely ridiculous". The BTC spot ETF began trading on January 11th (local time), with total trading volumes reaching $4.6 billion at that time. Meanwhile, $3.68 billion in major futures positions were liquidated in the last 24 hours on major exchanges. It has since barely held above 60K.

Bitcoin's recent gains have attracted a lot of investor attention, with 97% of addresses in profit, up about 2% from yesterday. Optimism (OP) and Ethereum (ETH) addresses are also in profit with 91% and 89% respectively. On the other hand, Algorand (ALGO) addresses are facing a cliff with only 12% in profit. Along with Algorand, the data also shows that Litecoin (LTC) and Phantom (FTM) holdings are only profitable for 40%-45% of addresses, respectively.

There are also signs of overheating in the crypto market. The website of major US exchange Coinbase crashed. Coinbase announced that its site performance has been degraded and that some users may see zero account balances. "You may experience errors when trading. We are working to resolve the issue," the exchange said, adding that user assets are safe. It added that some users experienced delays in ETH and ERC-20 transactions. Coinbase later added a notice that it was experiencing more than 10 times its peak load and had resolved the error.