Bitcoin rally faster, stronger because of spot ETFs

As the bitcoin market recovers from last week's correction and reclaims the $70,000 mark, an analysis suggests that this cycle's rally could be even faster due to ETFs. In a recent report, Swiss crypto commodities exchange 21Shares concluded that the current halving cycle could see a faster rally than previous cycles due to the impact of spot Bitcoin exchange-traded funds (ETFs). It added that the circumstances surrounding the upcoming halving event in April are quite different from historical patterns (past movements), with a combination of factors, especially on the supply and demand side, creating favorable supply-demand dynamics. As such, the halving rally is likely to start earlier than in the past.

Chief among these variables is that newly introduced spot ETFs are opening the door to significant institutional investors, leading to surging demand that is driving prices higher. Furthermore, even traditional financial institutions such as banks and wealth managers are starting to offer their clients the option to invest in bitcoin, further fueling demand, which could lead to a radical rally and higher prices in the future. Banks such as Wells Fargo and Merrill Lynch are offering their wealth management clients access to Bitcoin ETFs, while Morgan Stanley has reportedly begun evaluating Bitcoin funds to provide a brokerage platform. Cetera is also riding the new wave of demand, being one of the first asset managers to officially announce a policy on Bitcoin ETFs. While demand is surging, supply is shrinking. Existing Bitcoin holders are consolidating their holdings with confidence in future price movements, reducing the amount of supply in circulation, and there are fewer units on exchanges, which means less liquidity and fewer opportunities to buy.

"While the supply held by long-term holders decreased by 4%, from 14.9 million to 14.29 million, the supply of short-term holders surged by more than 33%, from 2.3 million to 3.07 million," said 21Shares analysts. "This phenomenon typically occurs at the beginning of a post-halving bull market, but due to the exogenous ETF demand, it appeared early, resulting in a near neutralization of the market." "This scenario coincides with exchange balances falling to a five-year low of $2.3 million, and coupled with the reduction in new bitcoin that will be created after the upcoming halving, will potentially further tighten supply."

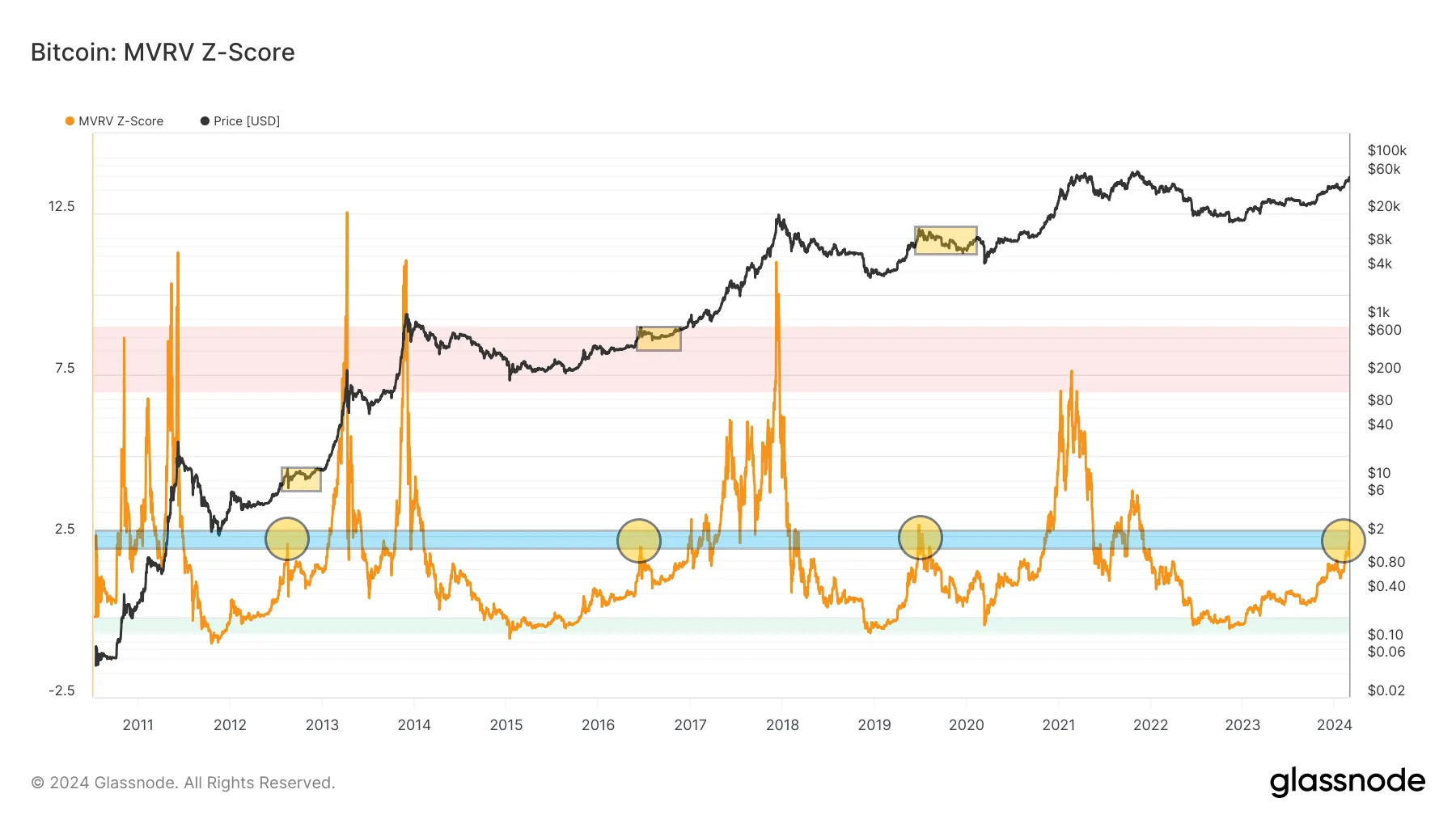

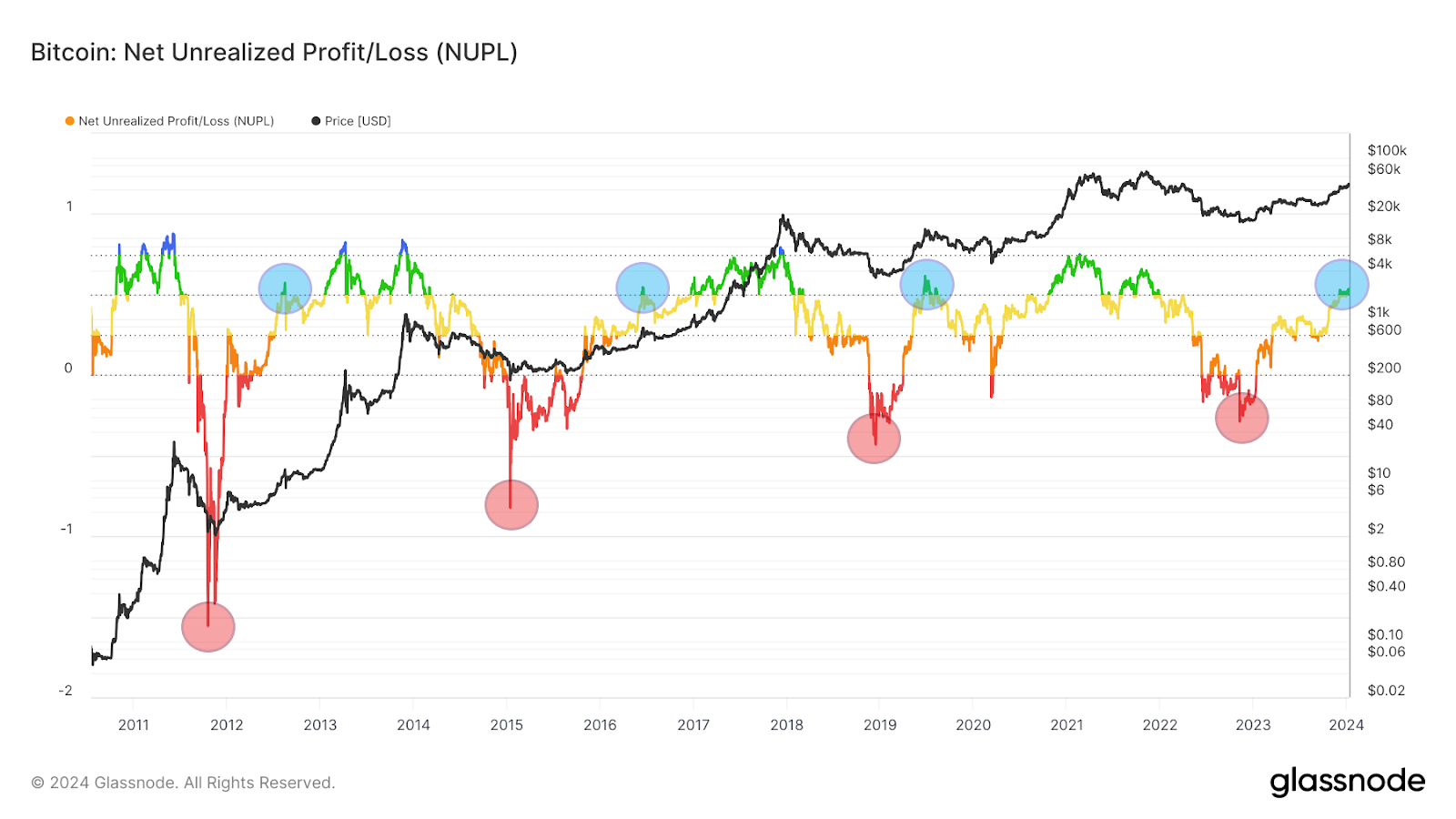

To back up its claims, 21Shares cited two technical indicators: market value-realized value (MVRV) and net unrealized profit and loss (NUPL). Currently, the MVRV Z-Score is around 3, which is lower than the 6 observed in February 2021 (the market peak), suggesting that Bitcoin may not have reached its peak value yet compared to 2021. However, the MVRV is still higher than the historical 3-period average of 1.07 for the period leading up to the halving event. NUPL also shows that investors have not reached the peak of their greed. This is because the current NUPL is around 0.6, which is lower than the 0.7 observed before the price spike to $60,000 in 2021. Compared to previous halving cycles, the current NUPL suggests that the bull market is growing.

Both MVRV and NUPL suggest that this halving cycle may be different, with the potential for early price spikes due to ETF inflows attracting new institutional investors. However, despite the optimistic signs, the report does not rule out the possibility of a short-term price correction. Historically, it takes about 172 days for Bitcoin to surpass its previous all-time high (ATH) and 308 days to reach the peak of a new cycle, but this cycle has already seen a new all-time high earlier this month. This is a departure from previous cycles, which traded 40-50% below their all-time highs in the weeks leading up to the halving. "Unlike previous cycles, the exogenous demand from ETF inflows could set a new precedent for price spikes, as evidenced by the price performance, which broke all-time highs before the halving," said 21shares.