Why Different Bitcoin Spot ETFs Have Different Prices

A recent news story is making waves in financial markets around the world. The Wall Street debut of spot bitcoin exchange traded funds (ETFs). Eleven U.S. Securities and Exchange Commission (SEC)-approved bitcoin spot ETFs were simultaneously listed on the New York Stock Exchange on Nov. 11 (local time). The first day report card for the 11 ETFs is stellar. The first day of trading saw a record $4.6 billion ($6 trillion) in daily trading volume.

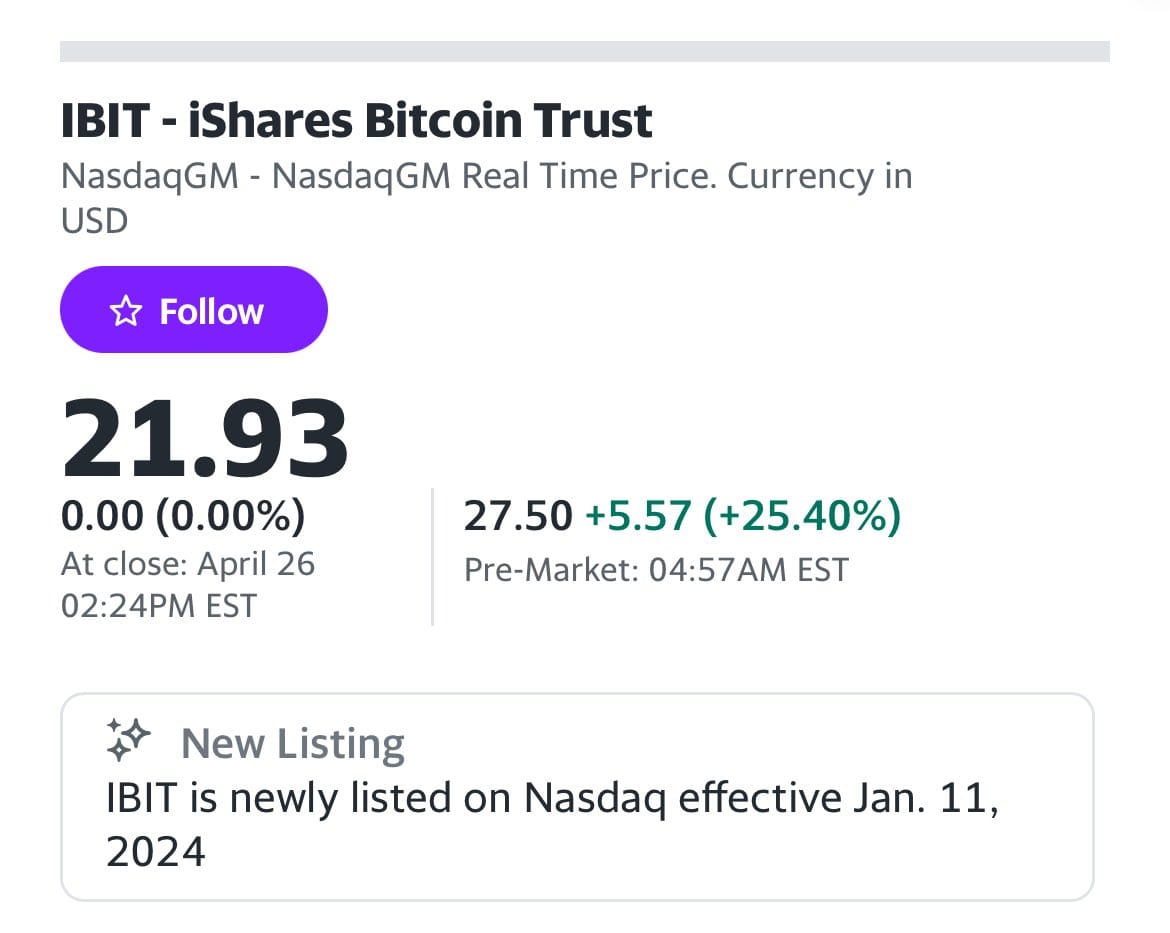

Every now and then I get a question and it's very simple, but no one seems to be talking about it, so I'll try to answer it. Let's compare two spot bitcoin ETFs listed on the NASDAQ: iShares Bitcoin Trust (IBIT) and Valkyrie's Bitcoin Fund (BRRR), both managed by BlackRock, the world's largest asset manager. On the 18th of this month, IBIT fell 4.38% to $23.34, and BRRR fell 4.69% to $11. The reason for the different prices despite having the same underlying asset, bitcoin, is that ETFs are, after all, financial instruments designed to trade like stocks, which means that the price per share varies depending on the number of shares issued - for example, if a bitcoin is worth $100, it's worth $10 each if divided into 10, and $1 each if divided into 100.

Meanwhile, the returns of the 11 spot bitcoin ETFs currently trading on the U.S. exchange are determined in real time by the price of the assets in their portfolios, and since all 11 hold only bitcoin in their portfolios, their returns will fluctuate with the price of bitcoin.