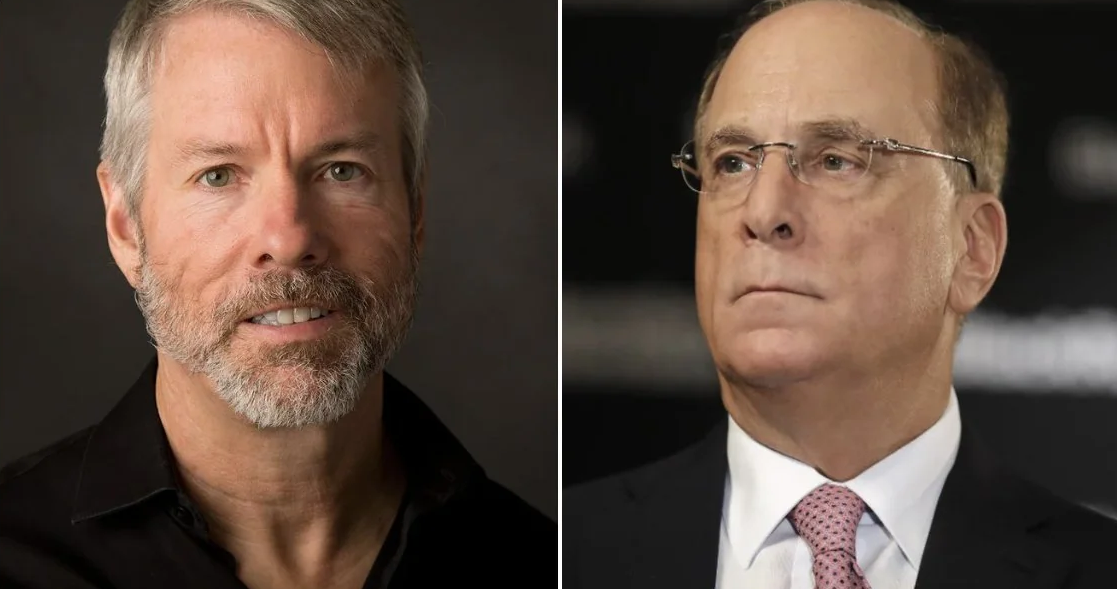

BlackRock likely to surpass MicroStrategy's (MSTR) BTC holdings as Ark Investments starts buying spot ETFs.

According to Cryptoslate, Eric Balchunas, an analyst specializing in ETFs at Bloomberg, said, "It's not long before BlackRock's bitcoin holdings surpass MicroStrategy's (MSTR). It's not a matter of if, but when." BlackRock previously disclosed on the official website of its bitcoin spot ETF iShares Bitcoin Trust (IBIT) that it held about 11,439 BTC as of Dec. 12.

Meanwhile, Nate Geraci, CEO of U.S.-based ETF specialist ETFstore, said that "Ark Investments today began purchasing the Ark 21 Shares Bitcoin ETF (ARKB) through a fund of funds". According to his repost, Ark sold the ProShares BTC Futures ETF (BITO) before buying ARKB. "Before selling the Grayscale Bitcoin Investment Trust (GBTC), Ark was paying a 2% annual fee on it," Nate Geraci wrote. For BITO, it's 0.95%. Now we've eliminated the fees for trading ARKB. It's a much more practical choice in terms of assets under management (AUM).